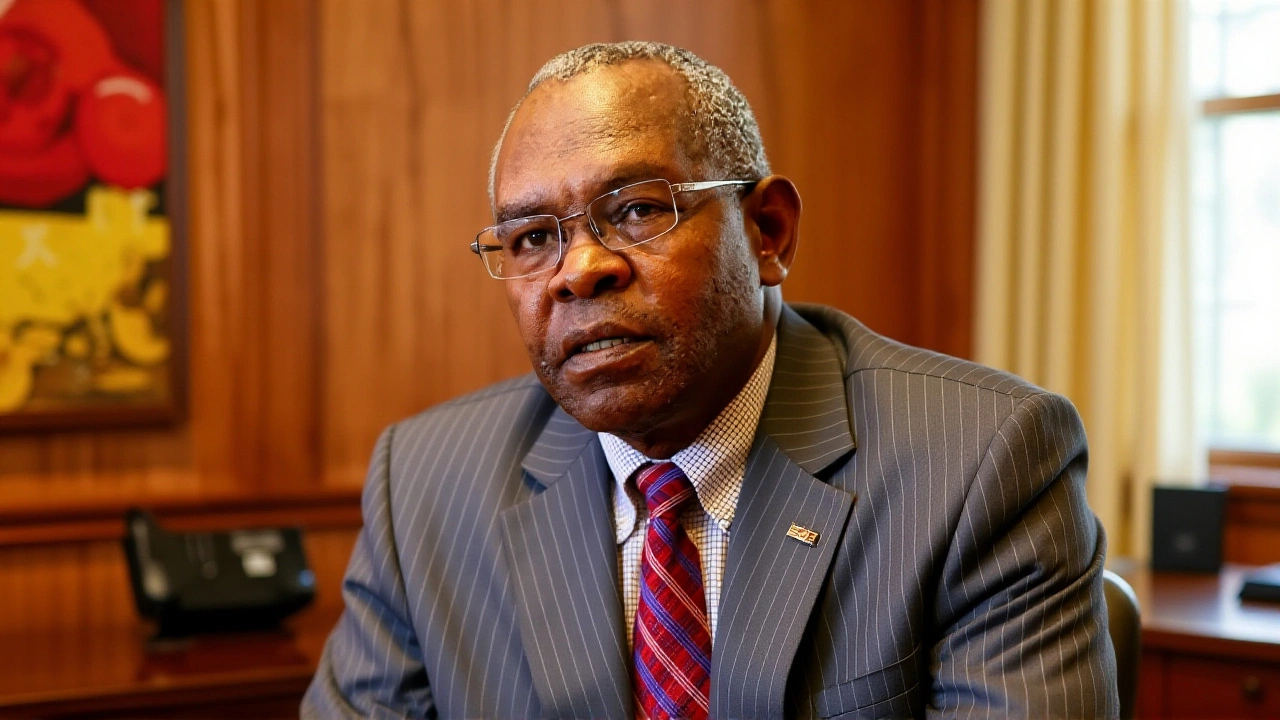

When David Koross, CEO and Managing Trustee of National Social Security Fund (NSSF) walked onto the stage at the International Social Security Association (ISSA) Technical Seminar in Nairobi on October 7, he didn’t shy away from the heat.

Koross told a packed room of regional delegates that the fund was "not credible" when the Office of the Auditor General (OAG) painted a picture of a Ksh 16‑17 billion shortfall for the financial year ending June 30, 2024. The audience, a mix of pensioners' advocates and policy‑movers, knew the stakes: the numbers could affect every Kenyan worker who contributes a slice of their paycheck to the scheme.

Why the Auditor General’s report matters

The OAG’s audit is the first time the fund received an unqualified opinion, which sounds like a clean bill of health. Yet the accompanying commentary flagged several red‑flag items that together topped roughly Ksh 16 billion. Among them were a Ksh 904 million tax‑refund snafu with the Kenya Revenue Authority (KRA), a botched land purchase in Upper Hill worth Ksh 115 million, and capital losses from bond premiums and equity investments that added up to more than Ksh 340 million.

Here’s the thing: the audit didn’t just list numbers, it pointed to processes that allegedly allowed money to sit idle or be mis‑allocated. For pensioners, idle cash means lost interest that could have boosted their retirement pots.

Koross’s point‑by‑point rebuttal

Koross methodically walked through each flagged category. He insisted the Ksh 904 million tax refund is being chased down, noting that the fund only became tax‑exempt after the payments were made in error. "We are actively recovering that amount," he said, adding that any delay merely reflects the bureaucracy of the KRA, not rogue behaviour by NSSF.

On the Upper Hill land deal, Koross reminded the audience that the title deed was revoked back in April 2010 because the parcel was earmarked for public use. "That loss is recognised in our books, but it doesn’t represent a current cash drain," he explained.

Bond premiums, which the OAG listed as a Ksh 272 million loss, were, according to Koross, written down after market‑driven re‑valuations. The fund, he argued, is already adjusting its portfolio to avoid similar premium‑risk exposure.

Equity positions that fell 17.64%—costing members about Ksh 27 million—were part of a broader diversification strategy. "We learned a lesson and are tightening our investment criteria," Koross said, pointing to a new internal risk‑review board set up in August 2024.

Finally, the audit highlighted Ksh 38 million in bank‑share write‑offs. Koross noted that these shares were part of a strategic partnership that never materialised, and the write‑off was booked in line with International Accounting Standards.

What the numbers really say about NSSF’s health

Even with the contested Ksh 16‑17 billion figure, the fund’s balance sheet shows assets swelling past Ksh 200 billion, with a projection to hit Ksh 600 billion by year‑end. The growth stems largely from a surge in contributions as the informal sector expands its coverage.

Processing times for pension benefits have also shrunk dramatically—from a staggering 86 days in early 2023 to under 10 days now. For retirees waiting on their monthly payouts, that speed‑up feels like a lifeline.

Yet the audit’s spotlight on mis‑managed expenditures has sparked calls from civil‑society groups for more transparency. The Commission on Administrative Justice (CAJ) already intervened earlier this year, demanding the fund publish its financial report promptly.

Reactions from stakeholders

Members’ unions expressed a mix of frustration and cautious optimism. "We’re relieved to hear the fund got an unqualified opinion, but the audit raises legitimate concerns," said Grace Mwangi, head of the Pensioners’ Advocacy Forum. "We’ll be watching the recovery of the tax refund closely."

Meanwhile, the International Social Security Association praised NSSF’s commitment to reform, noting that the technical seminar already showcased several best‑practice workshops on digital pension processing.

Financial analysts at Nairobi Securities Exchange’s research desk warned investors that while the fund’s asset growth is impressive, lingering doubts about governance could affect future bond‑issuance plans.

Looking ahead: what’s next for NSSF?

Koross announced that the fund will launch a real‑time dashboard for members by March 2025, allowing contributors to track their individual balances, investment performance, and any pending refunds.

In addition, NSSF plans to roll out a new “Youth Pension” product targeting workers under 30, aiming to boost membership by 15 % before the end of 2025.

Whether these initiatives will rebuild public trust remains to be seen, but the fund’s leadership appears keen to turn the audit’s criticisms into a springboard for change.

Key facts

- Auditor General’s report flagged roughly Ksh 16‑17 billion in questionable expenditures for FY 2024.

- Major loss items: Ksh 904 million tax refund to KRA, Ksh 115 million Upper Hill land deal, Ksh 272 million bond‑premium write‑offs, Ksh 27 million equity loss, Ksh 38 million bank‑share write‑offs.

- NSSF’s assets stand at over Ksh 200 billion, with a target of Ksh 600 billion by Dec 2024.

- Benefit processing time cut from 86 days to under 10 days.

- CAJ intervened to force timely publication of the FY 2024 financial report.

Frequently Asked Questions

How does the Auditor General’s report affect current pensioners?

If the flagged Ksh 904 million tax refund remains unrecovered, retirees lose out on the interest that could have been earned on that sum. Koross says the recovery is underway, but the delay means lower interim payouts for some members.

What steps is NSSF taking to prevent similar investment losses?

The fund has set up a new risk‑review board, tightened its equity‑investment criteria, and will publish a real‑time dashboard that lets members see where their contributions are allocated, aiming for greater transparency.

Why was the Upper Hill land purchase considered a loss?

The title deed was revoked in April 2010 because the land was reserved for public use. NSSF recorded the Ksh 115 million expense but the asset never generated a return, so it appears as a write‑off in the audit.

What role did the Commission on Administrative Justice play?

The CAJ intervened after NSSF delayed releasing its FY 2024 financial report. The commission’s order forced the fund to publish the audited statements, ensuring members could scrutinise the data.

Will the unqualified audit opinion influence future funding?

An unqualified opinion is a positive signal for creditors and investors. It could make it easier for NSSF to issue bonds or attract partnership capital, but analysts caution that lingering governance concerns must be addressed to sustain confidence.

Author

Ra'eesa Moosa

I am a journalist with a keen interest in covering the intricate details of daily events across Africa. My work focuses on delivering accurate and insightful news reports. Each day, I strive to bring light to the stories that shape our continent's narrative. My passion for digging deeper into issues helps in crafting stories that not only inform but also provoke thought.